Real estate investors do research for project viability, the demographics, the consumer sentiment, the market itself, and many other factors before they invest in commercial property or in residential projects. Many of them plan the projects to align with the city’s or the region’s expansion goals for transport, facilities, access to other cities, and so on. How many of them actually consider the possible impact of the changing climate on their assets that they are designing for the future?

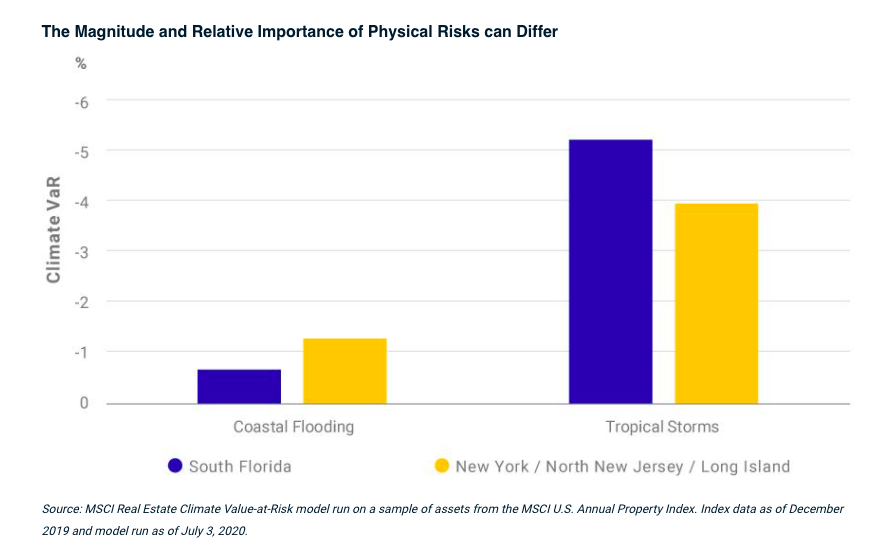

The Real Estate Climate Value-at-Risk (Climate VaR) model from MSCI shares useful insights on how the impact of physical risks varies in different types of assets and portfolios.

- Physical risks are related to the damage to buildings from extreme weather events caused by climate change. These changing weather patterns could cause both chronic (steady long-term) and acute (severe short-term) effects that can vary depending on geographic location and could increase the costs faced by investors.

- Transition risks could arise from efforts to address climate change and the transition to a low-carbon economy. They are based on the carbon intensity of the assets and estimate the potential costs of meeting carbon-reduction targets.

Real estate are fixed assets investments and these are long-term assets. Because of its strategic location, Chandigarh and its adjoining fast growing real estate hubs such as Mohali Aerocity promise a lot of economic growth in the region. The key is how the commercial property owners and the housing societies consider climate impact in their roadmaps.

People reacted to this story.

Show comments Hide comments[…] See related post: How modern real estate prepares itself for climate challenges […]

[…] building and construction are on the center stage for its role in climate concerns, worldwide. The Real Estate Climate Value-at-Risk (Climate VaR) model from MSCI shares some insights and details about the impact of physical risks on different types of real […]

[…] The commercial real estate owners and investors should realise that the modern real estate for office space is changing fast to prepare itself for the climate change. […]

[…] the modern real estate prepares itself for the climate changes, the property owners, stewards, investors, and tenants, all feel the impact on the building […]

[…] Modern real estate responding to the climate compliance: An MSCI report shows the risks involved and how real estate can contribute to the climate goals. […]