The last eighteen months of the pandemic brought a lot of changes in the employer-employee working models, which has directly impacted the landlord-tenant-operators in the commercial office real estate category. The property occupants, the operators, the supply chain vendors, and the commercial real estate builders and investors still working out their playbooks to make a result-orientated working proposition for the entire chain across the spectrum.

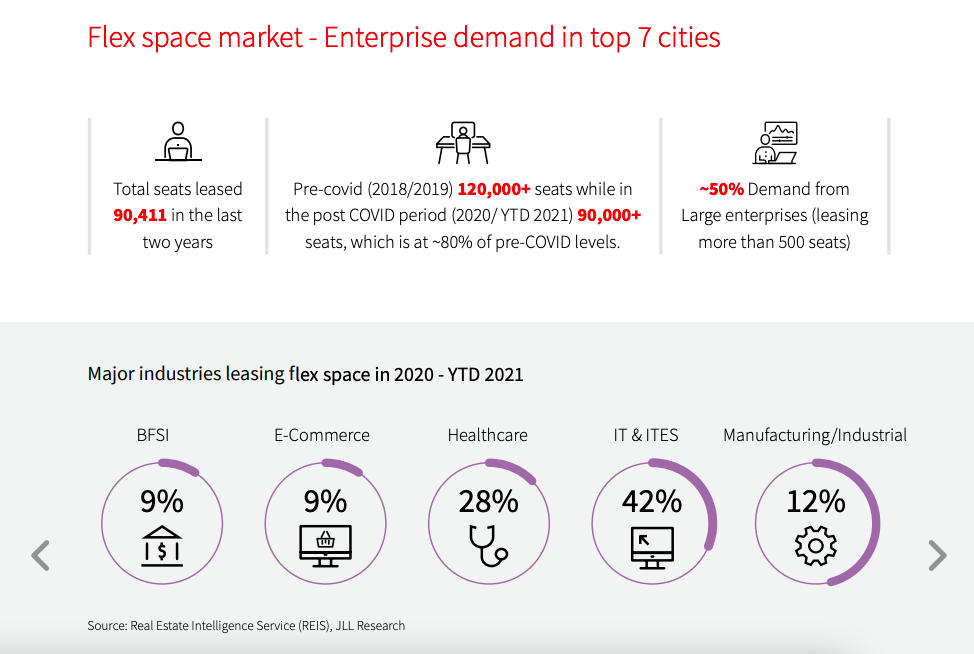

JLL has published a detailed research report that talks about flexible office space dynamics, trends, and some numbers that serve as key drivers for their business strategy. The report says:

- The share of flex in the total Grade-A office space leasing (in the top seven cities) in 2019 hit a high of 16%. It was the year of historic highs for the Indian office markets. It dipped to 9% in 2020, before reaching 13% in the first three quarters of 2021, though the absolute numbers remain off the previous highs.

- A flex space provider, which takes on the lease responsibility whilst also providing a fitted-out space and managing it, will give a considerable cost advantage to occupiers.

- Corporates are evaluating different workplace models, fostering the growth of flex operators in tier 2 cities.

The pandemic has changed the office space dynamics not only for the working models but the employees’ working sentiment too, such as compliance to climate and sustainability goals. It adds a new dimension to the landlord-tenant agreements such as green-lease and green buildings.

Looking at the growth of commercial real estate in Mohali and Zirakpur in 2021, we might see many new opportunities for the regional businesses and their workspace to get space in new and flexible office space that are designed with a fresh perspective for facilities, navigation, and working environment.

No Comments

Leave a comment Cancel